Multiple linear regression

Types of predictors

Jan 28, 2025

Announcements

Lab 02 due TODAY at 11:59pm

HW 01 due Thursday, January 30 at 11:59pm

Topics

Categorical predictors

Centering quantitative predictors

Standardizing quantitative predictors

Interaction terms

Computing setup

Data: Peer-to-peer lender

Today’s data is a sample of 50 loans made through a peer-to-peer lending club. The data is in the loan50 data frame in the openintro R package.

# A tibble: 50 × 4

annual_income_th debt_to_income verified_income interest_rate

<dbl> <dbl> <fct> <dbl>

1 59 0.558 Not Verified 10.9

2 60 1.31 Not Verified 9.92

3 75 1.06 Verified 26.3

4 75 0.574 Not Verified 9.92

5 254 0.238 Not Verified 9.43

6 67 1.08 Source Verified 9.92

7 28.8 0.0997 Source Verified 17.1

8 80 0.351 Not Verified 6.08

9 34 0.698 Not Verified 7.97

10 80 0.167 Source Verified 12.6

# ℹ 40 more rowsVariables

Predictors:

annual_income_th: Annual income (in $1000s)debt_to_income: Debt-to-income ratio, i.e. the percentage of a borrower’s total debt divided by their total incomeverified_income: Whether borrower’s income source and amount have been verified (Not Verified,Source Verified,Verified)

Response: interest_rate: Interest rate for the loan

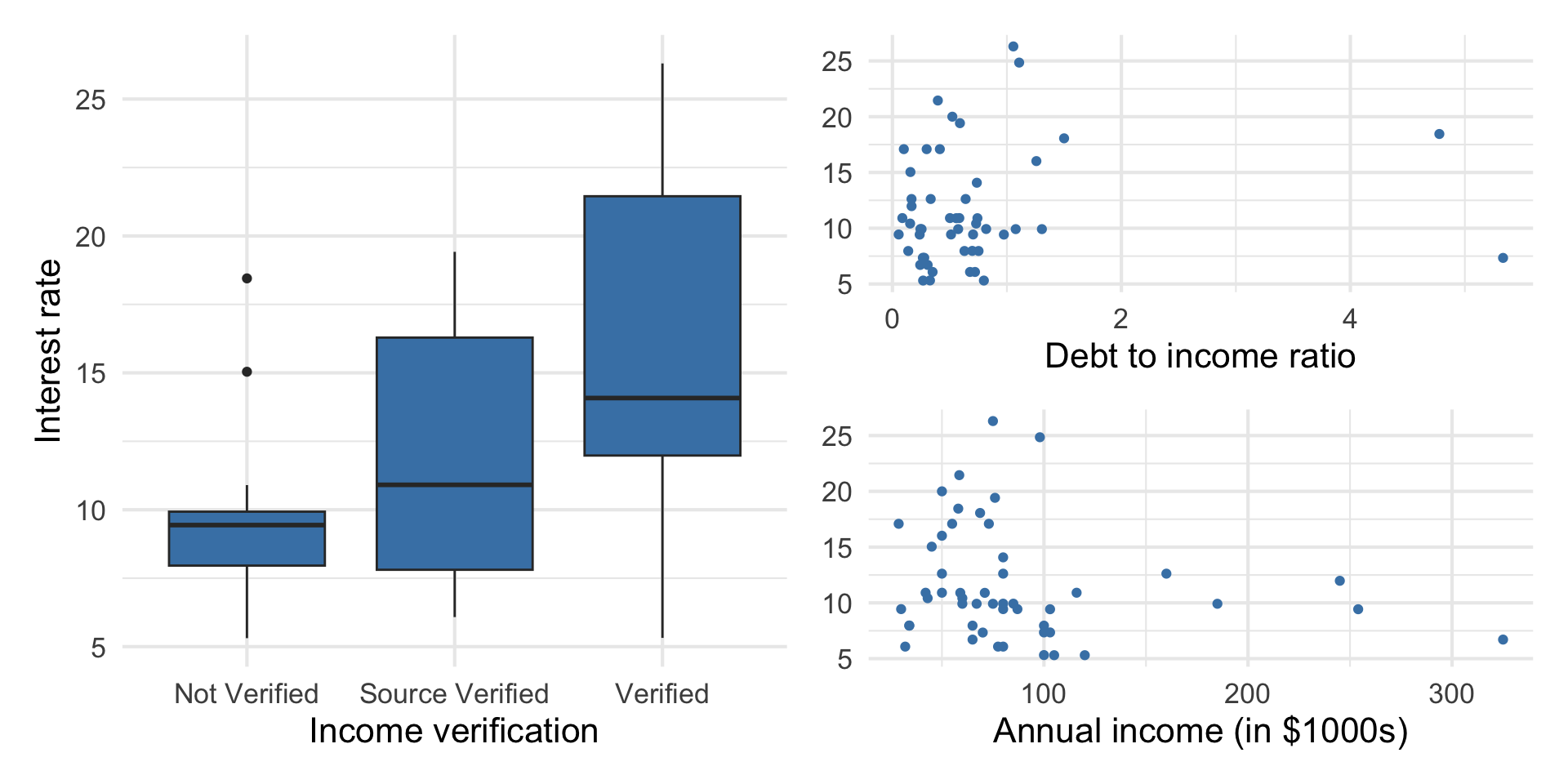

Response vs. predictors

Goal: Use these predictors in a single model to understand variability in interest rate.

Model fit in R

int_fit <- lm(interest_rate ~ debt_to_income + verified_income + annual_income_th,

data = loan50)

tidy(int_fit) |>

kable(digits = 3)| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 |

Categorical predictors

Matrix form of multiple linear regression

Indicator variables

Suppose there is a categorical variable with

We can make

An indicator (dummy) variable takes values 1 or 0

1 if the observation belongs to that level

0 if the observation does not belong to that level

Indicator variables

Suppose we want to predict the amount of sleep a Duke student gets based on whether they are in Pratt (Pratt Yes/ No are the only two options). Consider the model

Write out the design matrix for this hypothesized linear model.

Demonstrate that the design matrix is not of full column rank (that is, affirmatively provide one of the columns in terms of the others).

Use this intuition to explain why when we include categorical predictors, we cannot include both indicators for every level of the variable and an intercept.

Indicator variables for verified_income

# A tibble: 3 × 4

verified_income not_verified source_verified verified

<fct> <fct> <fct> <fct>

1 Not Verified 1 0 0

2 Verified 0 0 1

3 Source Verified 0 1 0 Indicator variables in the model

Given a categorical predictor with

- Use

- The baseline is the category that doesn’t have a term in the model

- This is also called the reference level

- The coefficients of the indicator variables in the model are interpreted as the expected change in the response compared to the baseline, holding all other variables constant.

Application exercise

📋 https://sta221-sp25.netlify.app/ae/ae-02-mlr.html

Complete Part 1

Interpreting verified_income

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 | 7.690 | 13.762 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

- The baseline level is

Not verified. - People with source verified income are expected to take a loan with an interest rate that is 2.211% higher, on average, than the rate on loans to those whose income is not verified, holding all else constant.

Centering

Centering a quantitative predictor means shifting every value by some constant

One common type of centering is mean-centering, in which every value of a predictor is shifted by its mean

Only quantitative predictors are centered

Center all quantitative predictors in the model for ease of interpretation

What is one reason one might want to center the quantitative predictors? What is are the units of centered variables?

Centering

Use the scale() function with center = TRUE and scale = FALSE to mean-center variables

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 |

| debt_to_inc_cent | 0.671 | 0.676 | 0.993 | 0.326 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 |

| annual_inc_cent | -0.021 | 0.011 | -1.804 | 0.078 |

Centering

| Term | Original Model | Centered Model |

|---|---|---|

| (Intercept) | 10.726 | 9.444 |

| debt_to_income | 0.671 | 0.671 |

| verified_incomeSource Verified | 2.211 | 2.211 |

| verified_incomeVerified | 6.880 | 6.880 |

| annual_income_th | -0.021 | -0.021 |

How has the model changed? How has the model remained the same?

Standardizing

Standardizing a quantitative predictor mean shifting every value by the mean and dividing by the standard deviation of that variable

Only quantitative predictors are standardized

Standardize all quantitative predictors in the model for ease of interpretation

What is one reason one might want to standardize the quantitative predictors? What is are the units of standardized variables?

Standardizing

Use the scale() function with center = TRUE and scale = TRUE to standardized variables

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 9.444 | 0.977 | 9.663 | 0.000 |

| debt_to_inc_std | 0.643 | 0.648 | 0.993 | 0.326 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 |

| annual_inc_std | -1.180 | 0.654 | -1.804 | 0.078 |

Standardizing

| Term | Original Model | Standardized Model |

|---|---|---|

| (Intercept) | 10.726 | 9.444 |

| debt_to_income | 0.671 | 0.643 |

| verified_incomeSource Verified | 2.211 | 2.211 |

| verified_incomeVerified | 6.880 | 6.880 |

| annual_income_th | -0.021 | -1.180 |

How has the model changed? How has the model remained the same?

Interaction terms

Interaction terms

- Sometimes the relationship between a predictor variable and the response depends on the value of another predictor variable.

- This is an interaction effect.

- To account for this, we can include interaction terms in the model.

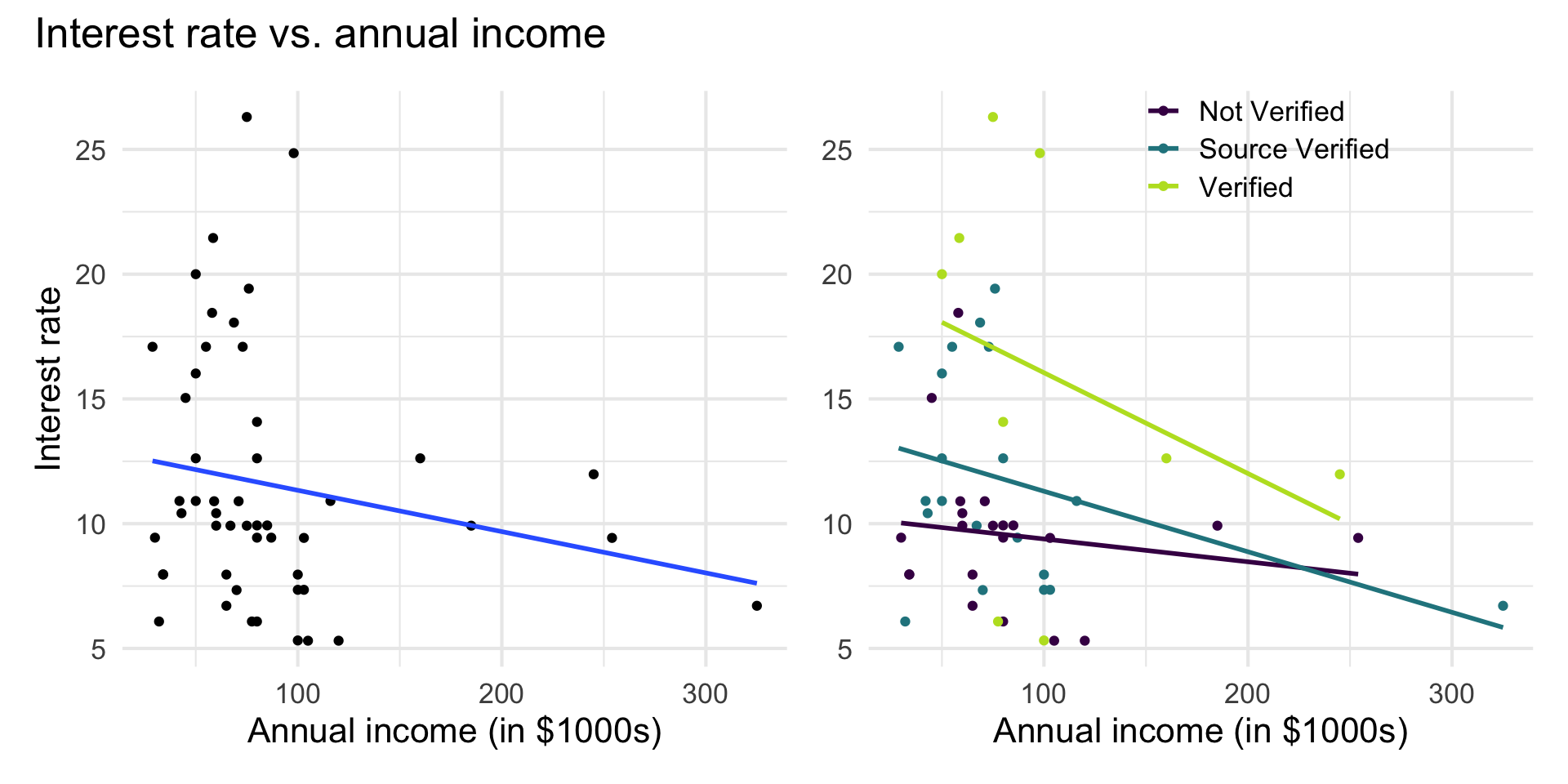

Interest rate vs. annual income

The lines are not parallel indicating there is a potential interaction effect. The slope of annual income differs based on the income verification.

Application exercise

📋 https://sta221-sp25.netlify.app/ae/ae-02-mlr.html

Complete Part 2

Interaction term in model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 9.560 | 2.034 | 4.700 | 0.000 |

| debt_to_income | 0.691 | 0.685 | 1.009 | 0.319 |

| verified_incomeSource Verified | 3.577 | 2.539 | 1.409 | 0.166 |

| verified_incomeVerified | 9.923 | 3.654 | 2.716 | 0.009 |

| annual_income_th | -0.007 | 0.020 | -0.341 | 0.735 |

| verified_incomeSource Verified:annual_income_th | -0.016 | 0.026 | -0.643 | 0.523 |

| verified_incomeVerified:annual_income_th | -0.032 | 0.033 | -0.979 | 0.333 |

Interpreting interaction terms

- What the interaction means: The effect of annual income on the interest rate differs by -0.016 when the income is source verified compared to when it is not verified, holding all else constant.

- Interpreting

annual_incomefor source verified: If the income is source verified, we expect the interest rate to decrease by 0.023% (-0.007 + -0.016) for each additional thousand dollars in annual income, holding all else constant.

Recap

Interpreted categorical predictors

Explored by

Fit and interpreted models with centered and standardized variables

Interpreted interaction terms

Next class

- Model comparison for multiple linear regression