# load packages

library(tidyverse)

library(tidymodels)

library(openintro)

library(patchwork)

library(knitr)

library(kableExtra)

# set default theme and larger font size for ggplot2

ggplot2::theme_set(ggplot2::theme_minimal(base_size = 16))Multiple linear regression (MLR)

Topics

Introducing multiple linear regression

Exploratory data analysis for multiple linear regression

Fitting the least squares line

Interpreting coefficients for quantitative predictors

Prediction

Computing setup

Data: Peer-to-peer lender

Today’s data is a sample of 50 loans made through a peer-to-peer lending club. The data is in the loan50 data frame in the openintro R package.

# A tibble: 50 × 4

annual_income debt_to_income verified_income interest_rate

<dbl> <dbl> <fct> <dbl>

1 59000 0.558 Not Verified 10.9

2 60000 1.31 Not Verified 9.92

3 75000 1.06 Verified 26.3

4 75000 0.574 Not Verified 9.92

5 254000 0.238 Not Verified 9.43

6 67000 1.08 Source Verified 9.92

7 28800 0.0997 Source Verified 17.1

8 80000 0.351 Not Verified 6.08

9 34000 0.698 Not Verified 7.97

10 80000 0.167 Source Verified 12.6

# ℹ 40 more rowsVariables

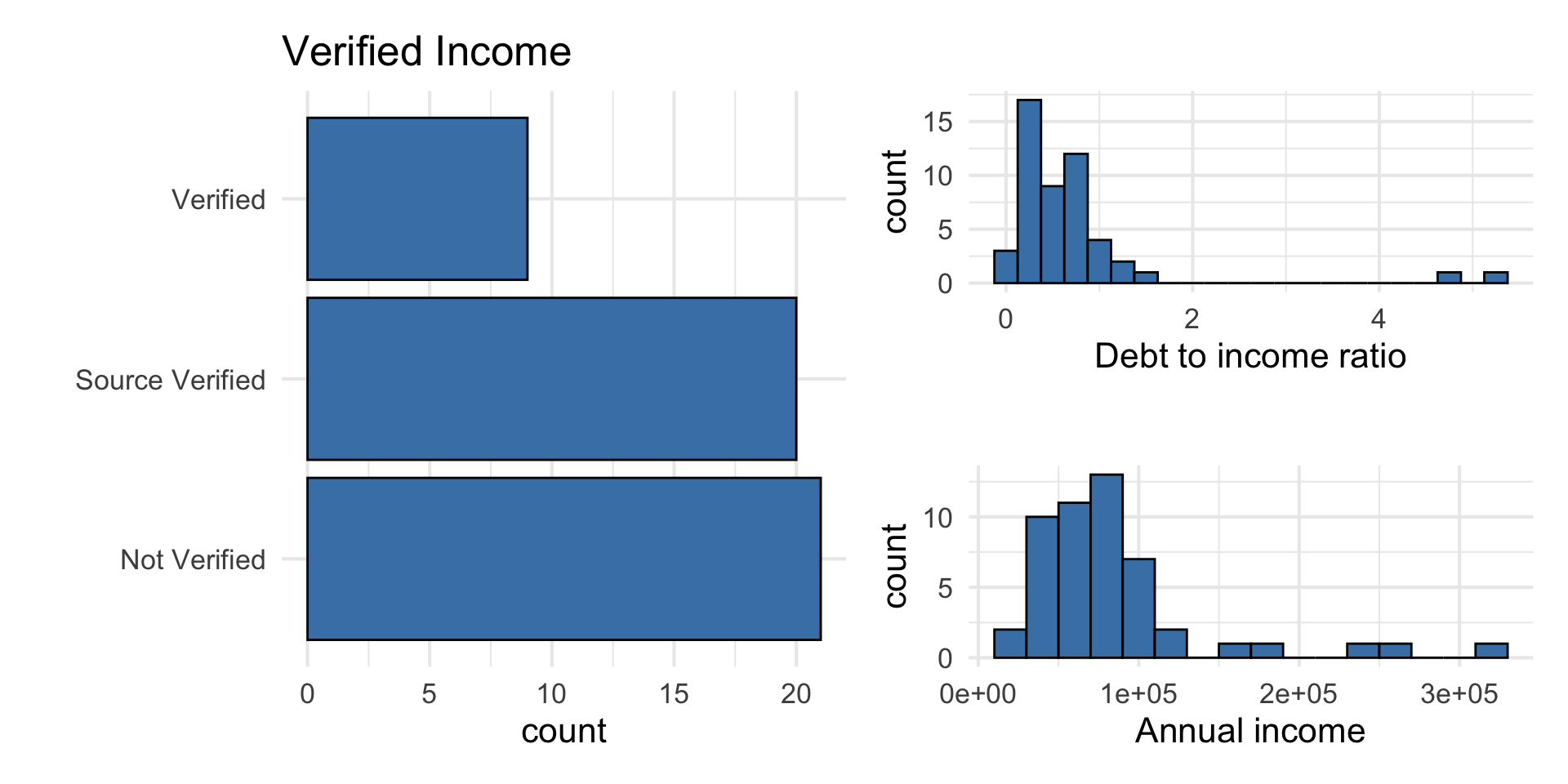

Predictors:

annual_income: Annual incomedebt_to_income: Debt-to-income ratio, i.e. the percentage of a borrower’s total debt divided by their total incomeverified_income: Whether borrower’s income source and amount have been verified (Not Verified,Source Verified,Verified)

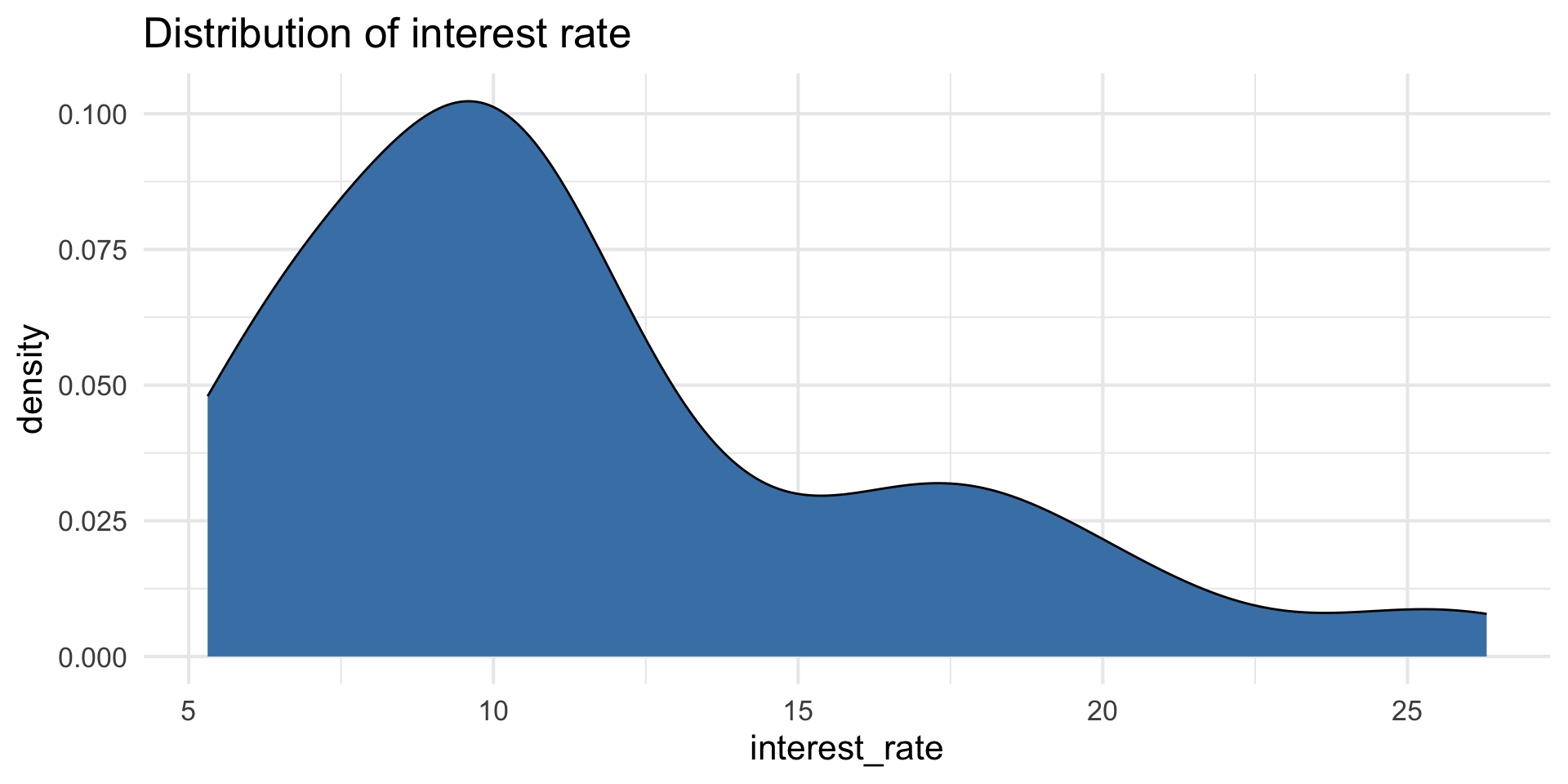

Outcome: interest_rate: Interest rate for the loan

Outcome: interest_rate

| Min | Median | Max | IQR |

|---|---|---|---|

| 5.31 | 9.93 | 26.3 | 5.755 |

Predictors

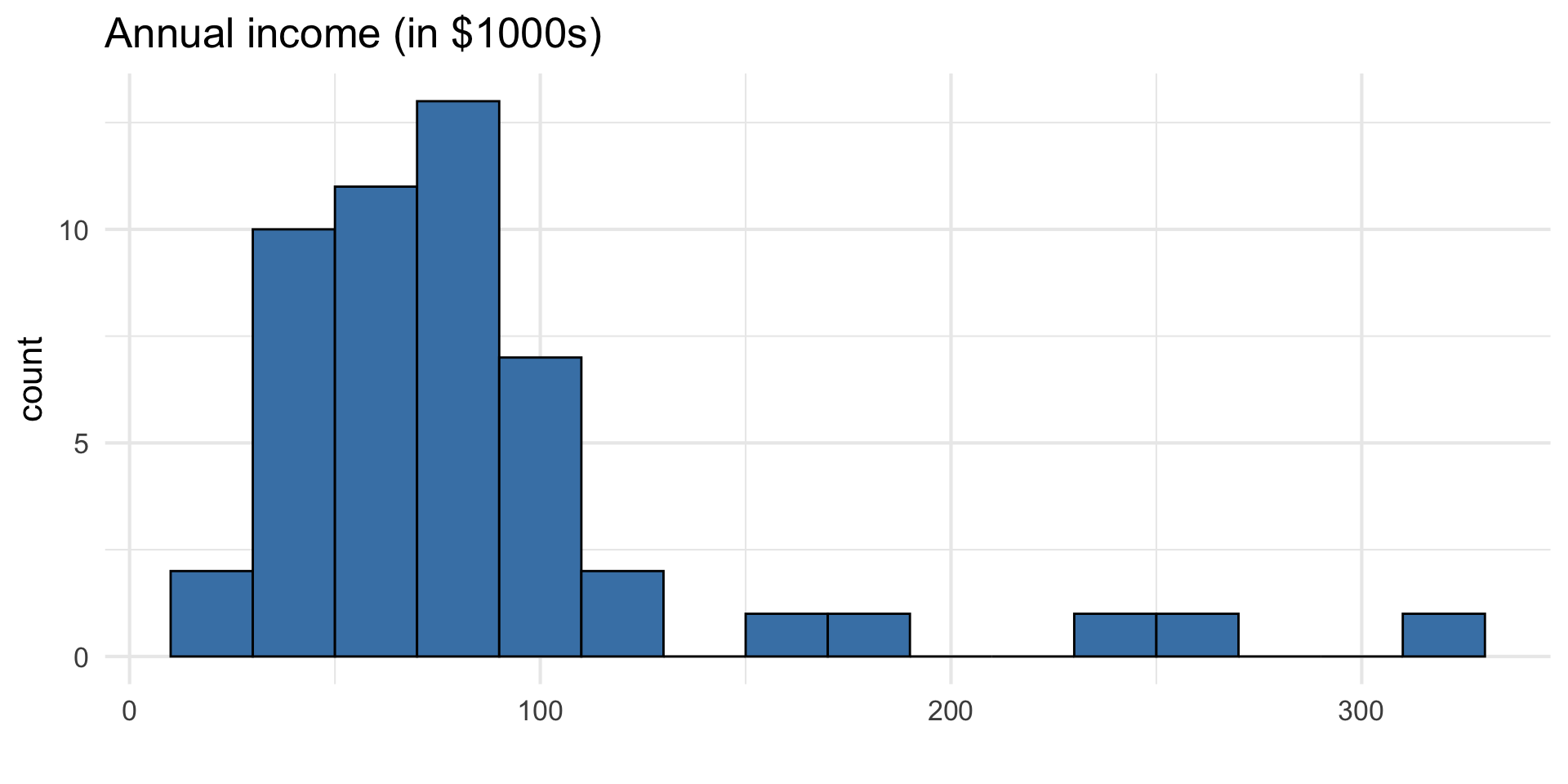

Data manipulation 1: Rescale income

loan50 <- loan50 |>

mutate(annual_income_th = annual_income / 1000)

. . .

Why did we rescale income?

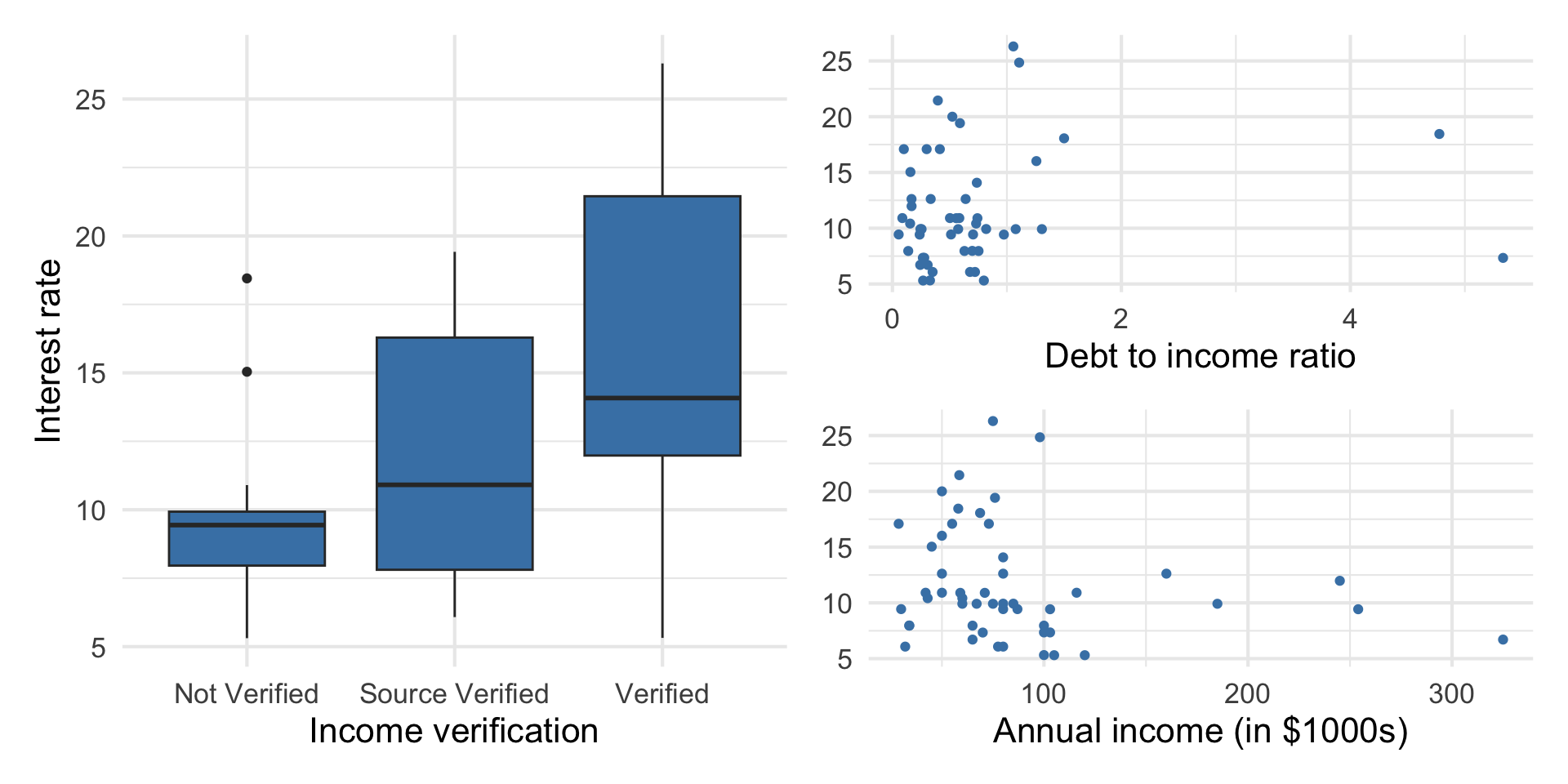

Outcome vs. predictors

. . .

Goal: Use these predictors in a single model to understand variability in interest rate.

. . .

Why do we want to use a single model versus 3 separate simple linear regression models?

Multiple linear regression (MLR)

Multiple linear regression (MLR)

Based on the analysis goals, we will use a multiple linear regression model of the following form

Multiple linear regression

Recall: The simple linear regression model

. . .

The form of the multiple linear regression model is

. . .

Therefore,

Fitting the least squares line

Similar to simple linear regression, we want to find estimates for

. . .

The calculations can be very tedious, especially if

Matrix form of multiple linear regression

Suppose we have

What are the dimensions of

Matrix form of multiple linear regression

As with simple linear regression, we have

. . .

Generalizing the derivations from SLR to

as before.

Model fit in R

int_fit <- lm(interest_rate ~ debt_to_income + verified_income + annual_income_th,

data = loan50)

tidy(int_fit) |>

kable(digits = 3)| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 |

Model equation

We will talk about why there are only two terms in the model for verified_income soon!

Interpreting

- The estimated coefficient

. . .

- Example: The estimated coefficient for

debt_to_incomeis 0.671. This means for each point in an borrower’s debt to income ratio, the interest rate on the loan is expected to be greater by 0.671%, on average, holding annual income and income verification constant.

Interpreting

The estimated coefficient for annual_income_th is -0.021. Interpret this coefficient in the context of the data.

Why do we need to include a statement about holding all other predictors constant?

Interpreting

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 10.726 | 1.507 | 7.116 | 0.000 | 7.690 | 13.762 |

| debt_to_income | 0.671 | 0.676 | 0.993 | 0.326 | -0.690 | 2.033 |

| verified_incomeSource Verified | 2.211 | 1.399 | 1.581 | 0.121 | -0.606 | 5.028 |

| verified_incomeVerified | 6.880 | 1.801 | 3.820 | 0.000 | 3.253 | 10.508 |

| annual_income_th | -0.021 | 0.011 | -1.804 | 0.078 | -0.043 | 0.002 |

. . .

Describe the subset of borrowers who are expected to get an interest rate of 10.726% based on our model. Is this interpretation meaningful? Why or why not?

Prediction

What is the predicted interest rate for an borrower with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000?

10.726 + 0.671 * 0.558 + 2.211 * 0 + 6.880 * 0 - 0.021 * 59[1] 9.861418. . .

The predicted interest rate for an borrower with with an debt-to-income ratio of 0.558, whose income is not verified, and who has an annual income of $59,000 is 9.86%.

Prediction in R

Just like with simple linear regression, we can use the predict() function in R to calculate the appropriate intervals for our predicted values:

new_borrower <- tibble(

debt_to_income = 0.558,

verified_income = "Not Verified",

annual_income_th = 59

)

predict(int_fit, new_borrower) 1

9.890888 Difference in predicted value due to rounding the coefficients on the previous slide.

Cautions

- Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

- The multiple regression model only shows association, not causality

- To show causality, you must have a carefully designed experiment or carefully account for confounding variables in an observational study

Recap

Showed exploratory data analysis for multiple linear regression

Used least squares to fit the regression line

Interpreted the coefficients for quantitative predictors

Predicted the response for new observations